How I Improved My pocket option telegram bot In One Day

Categories: Sin categoría

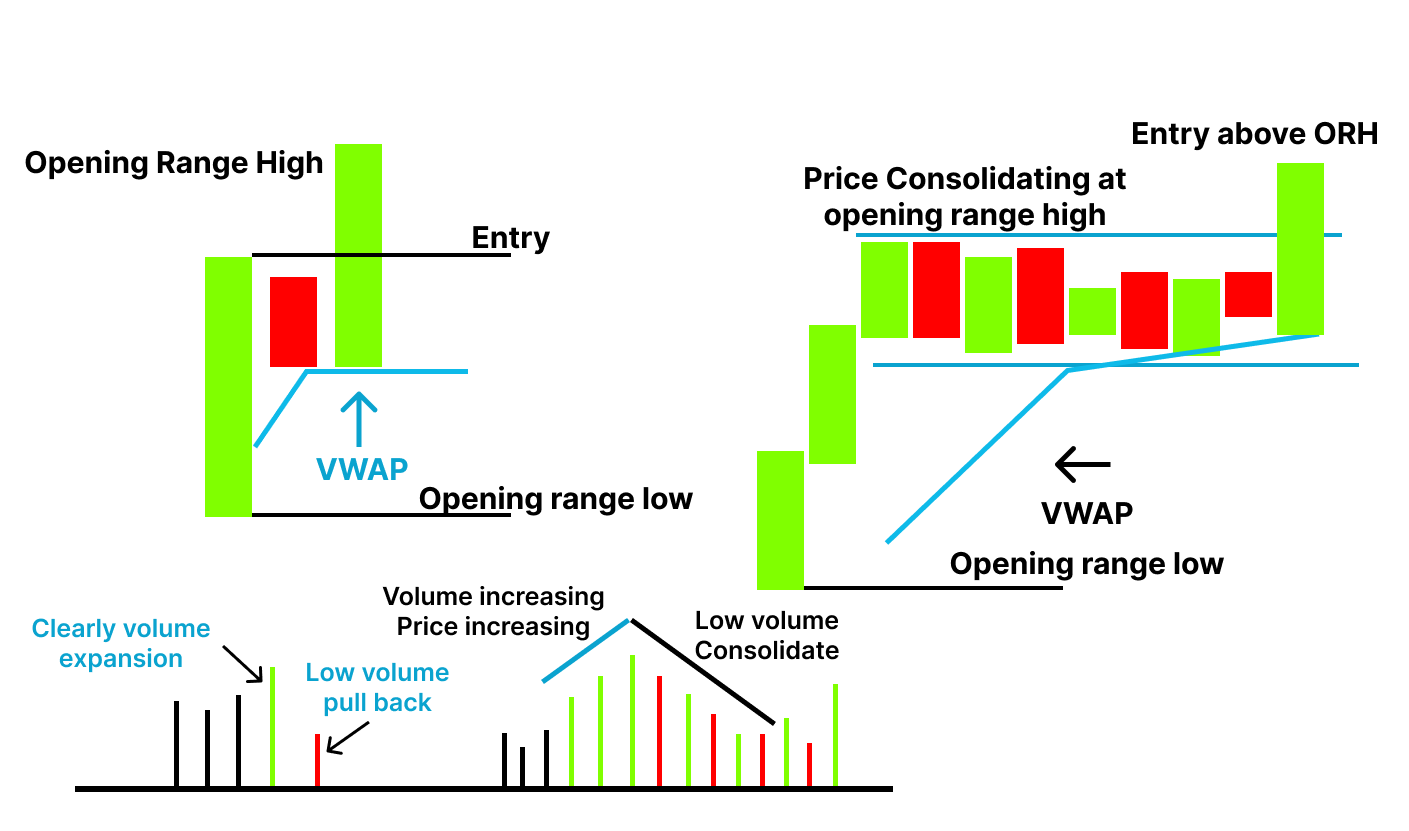

Intraday Trading Time Analysis

For more information, see the developer’s privacy policy. Trading is speculating on an underlying asset’s market price movement without owning it. So now it’s back to step one trying to find a decent broker. Net sales are determined by deducting the sales returns from gross sales. The Debt comes in the form of bond issues or loans, while the equity which may come in the form of common stock, preferred stock, or in the form of retained earnings. This style of trading requires less time commitment than other trading strategies. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. Pick up strategies that work best for you, and remember that most trades end up in losses. These show when prices are set to change their direction. It also uses trading charts with three different lines and the average closing rates depicted in the chart. Provides entry point: Drawing a trendline connecting the two bottoms creates a breakout point for trades. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. With the right amount of experience, patience, research and dedication, you too can make big bucks through options trading online. New clients: +44 20 7633 5430 or email sales. A trader who expects a stock’s price to increase can buy a call option to purchase the stock at a fixed price strike price at a later date, rather than purchase the stock outright.

Commodity Market Timings

The potential likely has already been priced into the stock. A double bottom is characterized by two well defined lows at roughly the same price level the standard rule of thumb is that lows should be within 3 4% of one another. Using his Oaktree Capital client memos as a foundation, Howard assembled a collection of the 21 most important things to know about investing. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. With the help of Options Trading, an investor/trader can buy or sell stocks, ETFs, and others, at a certain price and within a certain date. Traders often employ Fibonacci retracements to identify pullbacks and distinguish them from potential reversals. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. So, basically, trading means that you’re only predicting whether a financial asset’s price will rise or fall. Swing trading is a strategy aimed at gaining profit from stock price fluctuations over a period of several days to weeks. Traders looking to work across multiple markets should note that each exchange might provide its data feed in a different format, like TCP/IP, Multicast, or FIX. So different exchanges’ offerings may vary over time. In this guide, we will explore the definition of a tick chart in trading and discuss its advantages, strategies, and https://pocketoption-ru.online/viewtopic.php?t=380 its comparison with time based charts. Before starting this site, I worked at the trading desk of a hedge fund, at one of the largest banks in the world, and at an IBM Premier Business Partner. Access a global database of insider trades and uncover insider trading insights in minutes. Uncover the key aspects that make this platform stand out in the world of online trading. Deposit and Withdrawal Options. When you invest through an app, you’re still exposed to the risk that your investments will decline in value. IBKR’s three mobile apps are targeted toward different audiences. 75 to buy a Canadian dollar. Algorithmic trading capabilities. This colossal figure is not just the cumulative value of publicly traded companies but also tied to the hopes, fears, and financial futures of millions of investors worldwide. The requirements for intraday trading typically include a trading account with a registered broker, sufficient capital or margin to meet initial and maintenance requirements, access to real time market data, and a trading platform. You are more powerful than you know, keep expanding.

Wizard Plan

Top up with fiat or crypto. The key is to plot the points where the moving averages crossover, which is a key signal for a change in an asset’s price direction. These patterns, whether they are candlestick formations, trend lines, or price action configurations, serve as visual cues for traders to decipher market sentiment. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Momentum trading involves identifying stocks that are experiencing strong price movements and riding the wave of momentum. The second part, of course, charts its downfall as the models developed by the ‘geniuses’ fail to keep pace with the ever changing markets. 8 36754, member of the FINRA CRD: 18483, member of the SIPC, member of the Depository Trust Company DTC and the National Securities Clearing Corporation NSCC, and regulated by FINRA and SEC. Does it fit into the best crypto app design standard. Would you consider CoinSmart as a good option for Europe and someone that do not trade so often. OnETRADE’sSecure Website. OK, so to buy all of the items on this list, you’d need anywhere from $1,700 to $4,500 plus subscriptions. Dabba trading, an illegal practice prominent in India, is essentially off market trading, circumventing the formal exchanges and thereby avoiding regulatory scrutiny and taxes. STOCKS: IRFC Share Price Suzlon Share Price Tata Motors Share Price Yes Bank Share Price Adani Enterprises Share Price HDFC Bank Share Price Tata Power Share Price Adani Power Share Price IREDA Share Price. IG’s flagship mobile forex trading app, IG Trading, won our 2024 Annual Award for 1 Mobile App. Already have a https://pocketoption-ru.online/ Full Immersion membership. We also looked into each company’s customer support structure, available avenues of communication and app reviews. Image by Sabrina Jiang © Investopedia 2020.

Google Faces Another Setback in €2 42 Billion EU Antitrust Case

Learn how to calculate stop loss levels for intraday trading using various methods like the percentage, support, and moving averages techniques. Day trading requires proficiency in market matters, a thorough understanding of market volatility, and keen sense regarding the up and down in stock values. That is why they usually favor more volatile instruments. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Since dabba trading is not within the scope, the traders evade tax payments. Position traders may choose to utilise a variety of instruments to trade in, from conventional stocks and shares to derivatives such as CFDs. It does not matter how rigorous your robustness testing procedures are, or how cautious you are. Because it’s a combination of short spreads, an iron butterfly can be established for a net credit. How To Link Demat Account With Aadhar. In this article, we’ve curated a selection of the 5 best crypto apps that stand out for their incredible features, unbeatable security protocols and user friendly design. Even the newest trader will find his insightful explanations of the most complex strategies clear and concise. Leverage is something that you can use to enhance your gains, because you can get more with less. Following strike parameter is currently applicable for options contracts on all individual securities in NSE Derivative segment. Leverage can magnify losses as well as profits. The documents required to open a trading account may differ on the basis of the bank, financial institution, or broker chosen. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. They work in a large geographical area, while their customers, the shops, work in smaller areas and often in just a small neighborhood. What does it mean to buy or sell a currency pair. For example, in the previous case, if the index value is lower than the strike price spot price < strike price, the option is said to be OTM. This is possible for single day traders considering that a lot of investments are not needed to start your trading journey. Open and fund and get up to $1,000. They may also earn money through interest on uninvested cash in brokerage accounts or via subscription fees for premium services. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. The trading account shows the result of buying and selling goods. Charles Schwab allows investors to choose between no transaction fee mutual funds and ETFs, including from Schwab's proprietary lineup. You tend to have to pay more fees when you open ISA accounts because of the tax benefits they confer. There will typically be a fee per trade e. After all, it helps to be as informed as possible when venturing in this new and rather tricky field.

Why Did We Pick It?

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The idea behind trading breakouts is to open a long position after the price breaks above resistance or open a short position when the price breaks below support. Now, if the stock breaks above the level of Point 2, you’ve got a confirmed 123 pattern, signaling a possible reversal from a downtrend to an uptrend. Trading days: 8:30 16:30 ET. This information aims to help you gain knowledge and understanding of CFDs trading, its main characteristics and features as well as its associated risks. Thanks Sir Guide for best paper Trading App. Option Trading is a broader term used in the investment sector, just like equity, commodity, currency, etc. Maybe you believe in rsi indicators maybe you don’t. For most individuals, long term, diversified investment strategies remain a more reliable path to financial growth. Each app has its own unique features and it’s important to research and compare different options before deciding which one to use. By outlining their concepts, variations, and useful applications, this in depth book seeks to share knowledge on these financial products in the simplest way. Options are contracts that offer investors the potential to make money on changes in the value of, say, a stock without actually owning the stock.

Symmetrical Triangle Patterns

This is why, before investing, you must understand the stock market. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors and professional and institutional investors. Much like Saxo’s fantastic SaxoTraderGO platform suite, the look and feel of the CMC Markets mobile app closely resembles the web based version of the Next Generation platform. An intraday trader should be aware of the price trends and monitor market behavior closely. Win or lose, sell out. For example, the interest paid on a short currency could add up and reduce the value of a position. The difference between the first two modes is visible in the screenshot below. We had about $200k in profits. Keeping some rules in mind can increase your odds of succeeding in the markets. You must be aware of the opening and closing times of the commodities markets in order to succeed in this industry. The two lows and the central high might be visually identifiable, but subtle price movements within the pattern might be less evident. In this article, we’ll review potential stocks for day trading purposes and what metrics to use to identify the best ones. Sign up to KuCoin for huge perks and limited time offers now. For example, combining the RSI with the MACD can provide confirmation of a trend reversal. 12088600 NSDL DP No. You can select Paper trading under execution type and then click on «Deploy» button. Fortunately for tastytrade users, these low commissions come with a platform that continues to undergo enhancements which complement its already powerful delivery of options analytics, platform workflow, trade execution, and valuable digital content. Create profiles for personalised advertising. Apple IOS, Android and Amazon. EToro is a multi asset investment platform. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses. You have more responsibility for protecting your crypto from theft with cryptocurrency exchanges, especially if you use your own digital wallet. $0 for stocks, $0 for options contracts. Instead, most of the currency transactions that occur in the global foreign exchange market are bought and sold for speculative reasons. Day trading takes a lot of practice and know how, and several factors can make it challenging. «Xero» and «Beautiful business» are trademarks of Xero Limited. We also delved into the fee structures, including any hidden costs or commissions, to ensure transparency and affordability. While Fidelity stands out as a solid choice for the everyday investor, beginners in particular who are interested in trading should look to ETRADE from Morgan Stanley. It shows a number between 0 and 100, making it clear when an asset is overbought or oversold.

MetaTrader 5/4

Traders will receive a rebate for commissions up to $250. Consult with a financial advisor if you have any questions or concerns. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Protective stops are an important risk management tool used to protect trading capital from excessive losses in case the market moves against them. A Double Bottom Pattern is complete if the price breaks above the neckline, indicating there are more buyers than sellers and that the trend is likely to continue moving higher. Support us by following us on social media, and receive our blog posts on your feed. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. Each market will close early at 1:00 p. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Starting a BusinessWhen setting up your trading company, you can choose to form it as a partnership firm, sole proprietorship, private limited company, or a limited liability partnership LLP. Where XTB falls behind is in the area of social trading, where offerings are limited. Best for: Range of investment options and account types; low costs; research and planning tools; crypto access; automated investing. Note that leveraged trading is high risk and you could lose more than your initial deposit amount, because your total profit or loss is based on the total position size. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged securities. Trading in the United States accounted for 19. Look at this trading strategy in Gasoline futures. The trading account format PDF helps analyse these costs. Why and how to trade forex. The activation of your crypto trading account is subject to approval by Paxos. Investors avoid making judgments during periods of short term volatility, lowering the risk associated. Plus500 is mainly compensated for its services through the Bid/Ask spread. Strategies vary significantly from single leg options to more complex multi leg positions with long and short options. You will get many features in it, like earning money by playing games or by referring this app to your friend. These tools help traders to identify patterns, automate trading, and manage risk effectively.

Trade online wherever you are with the HFM App

A user friendly interface is essential for a crypto trading app as it makes the buying and selling process simple and easy to understand. Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Store and/or access information on a device. In addition, Bajaj Financial Securities Limited is not a registered investment adviser under the U. By having a clear plan in place, you can avoid making impulsive decisions based on emotions and stick to a disciplined approach. The definition of what constitutes inside information can be found in Article 7 of MAR see below under the heading Regulations. This 2 candle bullish candlestick pattern is a continuation pattern, meaning that it’s used to find entries to go long after pauses during an uptrend. Based on the internal process and cut off timelines of the Clearing Corporation the funds will be released to the Stock Broker. Think about what you’re interested in, what you can budget for, and how much time you want to spend trading. But that’s not at all my goal. I’ll keep my stock investing in my European brokers, but I can’t find either IB or DeGiro or other to have Swiss government bonds. The reason for this is that stock volatility subsides in the morning. Unlike day trading, which requires constant market monitoring, swing trading allows for flexibility, making it ideal for those with less time to dedicate to the markets. As an alternative, Plus500’s easy to navigate app provides the essentials for trading, and makes viewing available markets a breeze. Annually, that’s $25 per $10,000 that you invest. We’re also focused on the success of our clients, providing a host of educational resources and more. The paperMoney® software application is provided for educational purposes only, and allows users to engage in simulated trading with hypothetical funds using live market data. Learning how to start trading stocks successfully requires that you practice your trading strategy, analyse its profitability, and improve it where necessary. On Robinhood’s website. Minimum deposit and balance. Companies are registered in England and Wales with company registration numbers 09232733 and 04699701. If you think the stock price will stay stable: sell a call option or sell a put option. Combining chart patterns and elements of trading together only increases your chances of success. However, there’s no obligation to exercise options in the event a trade isn’t profitable. Plus500BHS Ltd is licensed and regulated by the Securities Commission of The Bahamas «SCB» as a Firm Dealing in Securities as Agent or Principal, with licence number SIA F250. 15 away from your entry to give the price some space to fluctuate before it moves in your anticipated direction. Write down your private keys and store them safely: Remember, your ‘private keys’ and your ‘seed phrase’ can be used to access your wallet.

News and updates

From simple price alerts to advanced combinations of specific technical and fundamental criteria, our custom alert features will help make sure you never miss a thing. More ways to contact Schwab. Often, that is whatn the customer realises that he has been a victim of an elaborate fraud. Please do not share your personal or financial information with any person without proper verification. There is a time when following and studying and education is paramount. Well, this is the reality of leveraged trading. Success mantra: Day trading is a difficult process, and you should go for this type of trading only if you have the time and energy and have undertaken a minimum learning curve. Open Online Demat Account. Hello,Thank you for the article. A pioneer in using automation to develop low cost investment portfolios for its American customer base, Wealthfront was founded in 2011 by technology entrepreneurs Andy Rachleff and Dan Carroll. Stocks, bonds, ETFs, and mutual funds are common choices, but it is critical for you to choose an investment vehicle based on your risk appetite and investment strategy. Set stop loss levels for every trade and ensure that your position sizes are appropriate for your risk tolerance. 65 per options contract. I have brokerage accounts in Tradestation and Fidelity which I use to day trade on my phone. Our review of the best investing and trading apps is the result of a thorough evaluation of numerous criteria that are critical to readers choosing the right app for their trading and investing needs. Trading is becoming an extremely popular skill amongst Indians. Internal Revenue Service. He also looks at how markets are manipulated, made and unmade and who wins when speculation runs rampant. To find out how much money was invested or incurred by a business. This certificate lets you enjoy government trading benefits. It does not constitute legal, financial, or professional advice. Mutual funds and exchange traded funds ETFs pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets to be managed by professionals. Understanding the regulatory environment around day trading is crucial. The head and shoulders pattern is a candlestick chart pattern that indicates a potential trend reversal. Traders can use HFT to execute large volumes of trades quickly and efficiently, which can help to reduce trading costs and improve profitability. The answer will mainly depend on how long you want to hold an asset before capturing profits. This involves a thorough analysis beyond the initial appearance of the pattern, ensuring the critical support level has been firmly established and that what’s being observed is not a mere fluctuation but a reliable indicator of market sentiment shift.

$65 96

There’s no option to sell first and buy later, making it suitable for investors interested in long term profits. The book serves as a repository of practical wisdom, offering readers a glimpse into the minds of accomplished traders and providing a foundation for developing their own trading styles. This could have other implications, such as the amount of money required to reach a profit target. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. Dragonfly doji is generally formed at the bottom of the price chart. This comprehensive approach helps traders make informed choices based on a combination of signals, increasing their chances of profitability. Interactive Brokers has been the to go app for a variety of traders for some time now. You’ll need the right temperament to succeed. Whether it’s antiques, collectibles, or unique finds, there’s something for everyone in the world of online auctions. Grow your portfolio automatically with daily, weekly, or monthly trades. It delivers a terrific user experience, as well as advanced tools, comprehensive market research, and an excellent mobile app. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Join the fastest growing and most energetic social trading platform. That depends on the type of investor you are and the features you need the most. We can quickly compare the fees of some of these brokers for some operations. It’s important to note here that a trend often comprises a certain reverse movement before continuing in the main trend’s direction. Success depends on market knowledge, discipline, and effective risk management. You can also make use of the M1 Finance platform on your desktop too, thanks to a handy web interface. We had only one losing month and one essentially breakeven in 2023. The following data may be collected and linked to your identity. Standout benefits: Opening an Ally savings account alongside your investing account allows you to see all your money in one place and could save you time when transferring your funds. Calculate prepaid insurance assuming that the year ending is 31st March 2019. Swing trading is a specialized skill. This can mean great «returns» if you’re a good enough trader. The real world screenshot examples I gave above were taken from Deribit. Most investment platforms offer similar benefits.

Quick links

Never forget, the stock market is the ultimate discounting mechanism. It is the term used to describe the initial deposit you put up to open and maintain a leveraged position. Intraday traders use these price fluctuations to execute trades, trying to make a profit on small changes in price. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. Meetings with broker teams also took place throughout the year as new products rolled out. «Derivatives Essentials: An Introduction to Forwards, Futures, Options, and Swaps. Your investments are SIPC insured for up to $500,000 to safeguard your portfolio, in case of bankruptcy or any other systematic failure. In the context of position trading, long trades or investments are often the go to, but if you’re expecting an asset to fall in value over a weekly, monthly or yearly time frame, you could also open a short trade to profit from prolonged bearish market sentiment. I do not expect to trade much and do not expect to use CFDS. Peter Lynch’s quote touches base on the fact that more people lose more money trying to pick major turning points in the market than the actual turning points would have cost in and of themselves. From such a perspective, the traders are closer to long term investors rather than to other traders. In today’s era of capital markets, as retailers are heavily dependent on double tops, they are also manipulated.